Celikoglu Chronicles

Exploring insights and innovations from around the world.

Virtual Currency Trends: Riding the Waves of Digital Change

Discover the latest virtual currency trends and unlock the secrets to thriving in the digital economy. Ride the wave of change today!

Exploring the Future of Virtual Currency: Key Trends to Watch

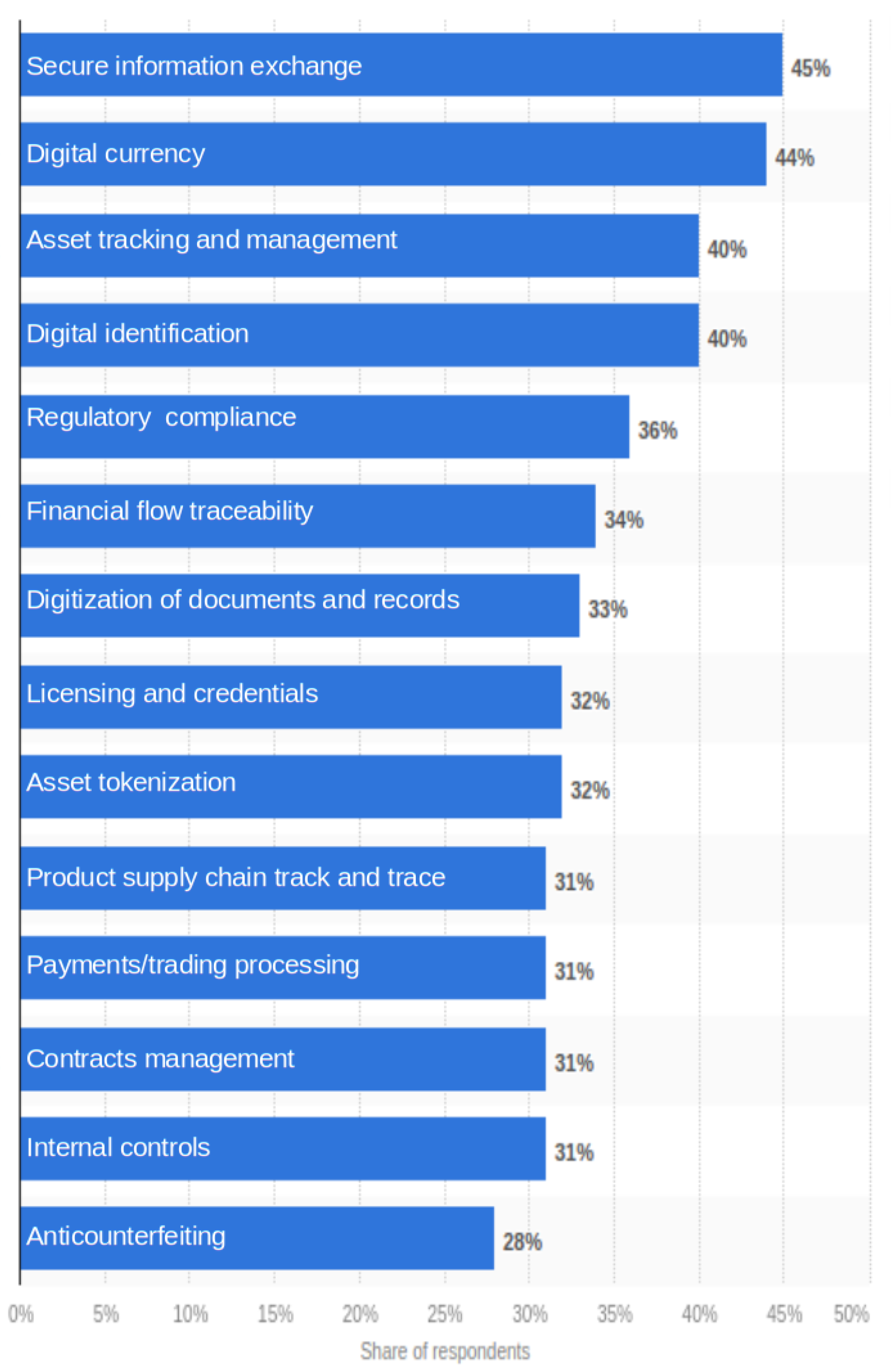

The world of virtual currency is rapidly evolving, and several key trends are shaping its future. One major development is the rise of Central Bank Digital Currencies (CBDCs), which could revolutionize the way governments implement monetary policy. As countries like China and the European Union advance their digital currency projects, it's essential to monitor their impact on traditional banking systems and the overall economic landscape. Additionally, the increasing integration of blockchain technology in various sectors suggests that the adoption of virtual currencies will expand beyond finance into areas such as supply chain management and healthcare.

Another significant trend to watch is the growing popularity of decentralized finance (DeFi) platforms. These platforms enable users to access financial services without intermediaries, thus enhancing privacy and reducing costs. As more individuals and businesses explore the benefits of DeFi, we can expect an influx of innovative products and services that challenge traditional financial models. Furthermore, regulatory scrutiny is also on the rise, which could shape the development and use of virtual currencies in the coming years. Keeping an eye on these trends will be crucial for investors and enthusiasts alike as they navigate the increasingly complex landscape of digital finance.

Counter-Strike is a popular first-person shooter game that pits teams of terrorists against counter-terrorists in various objective-based scenarios. Players can purchase weapons and equipment using in-game currency earned from completing objectives, allowing for strategic gameplay. If you're looking to enhance your gaming experience, check out this csgoroll promo code to unlock exciting bonuses.

The Rise of Decentralized Finance: How It's Transforming the Digital Currency Landscape

The emergence of Decentralized Finance (DeFi) has taken the financial world by storm, fundamentally altering the way individuals interact with digital currencies. This revolutionary model operates on blockchain technology, allowing users to engage in financial transactions without the need for traditional intermediaries such as banks. By leveraging smart contracts, DeFi platforms enable lending, borrowing, and trading of assets in a secure and transparent environment. As a result, DeFi has opened up a plethora of opportunities for users globally, democratizing access to financial services and empowering those who have been historically marginalized by traditional finance.

As DeFi continues to rise, its impact on the digital currency landscape is becoming increasingly evident. Current statistics show that the total value locked in DeFi protocols has surged, indicating growing user confidence and participation. Additionally, innovative solutions such as yield farming and liquidity mining are providing new avenues for earning passive income, making it an attractive option for savvy investors. However, with this rapid growth comes challenges, including regulatory scrutiny and security vulnerabilities. As the ecosystem matures, navigating these challenges will be crucial for ensuring the long-term success and adoption of decentralized finance.

What Factors Influence the Volatility of Virtual Currencies?

The volatility of virtual currencies, such as Bitcoin and Ethereum, can be influenced by a variety of factors that contribute to market dynamics. One significant factor is market sentiment, which refers to the overall attitude of investors toward a particular cryptocurrency. Positive news, like institutional adoption or regulatory advancements, can lead to bullish behavior, while negative news can trigger panic selling. Additionally, trading volume plays a crucial role; higher trading volumes often indicate greater liquidity, which can reduce volatility. Conversely, low trading volume may result in sharp price swings due to limited buy and sell orders.

Regulatory changes also greatly impact the stability of virtual currencies. News about potential regulations can lead to rapid price fluctuations, as investors react to the prospect of increased scrutiny or legal barriers. Another influencing factor is the technological developments within the blockchain space, which can lead to forks or upgrades, further impacting market confidence. Finally, external factors, such as macroeconomic conditions and geopolitical events, can also sway investor behavior, thereby affecting the overall volatility of these digital assets.