Celikoglu Chronicles

Exploring insights and innovations from around the world.

When Life Throws Curveballs: Why Disability Insurance is Your Safety Net

Discover how disability insurance can safeguard your future when life's unexpected challenges arise. Don't leave your safety to chance!

Understanding the Importance of Disability Insurance: Protecting Your Income When Life Changes

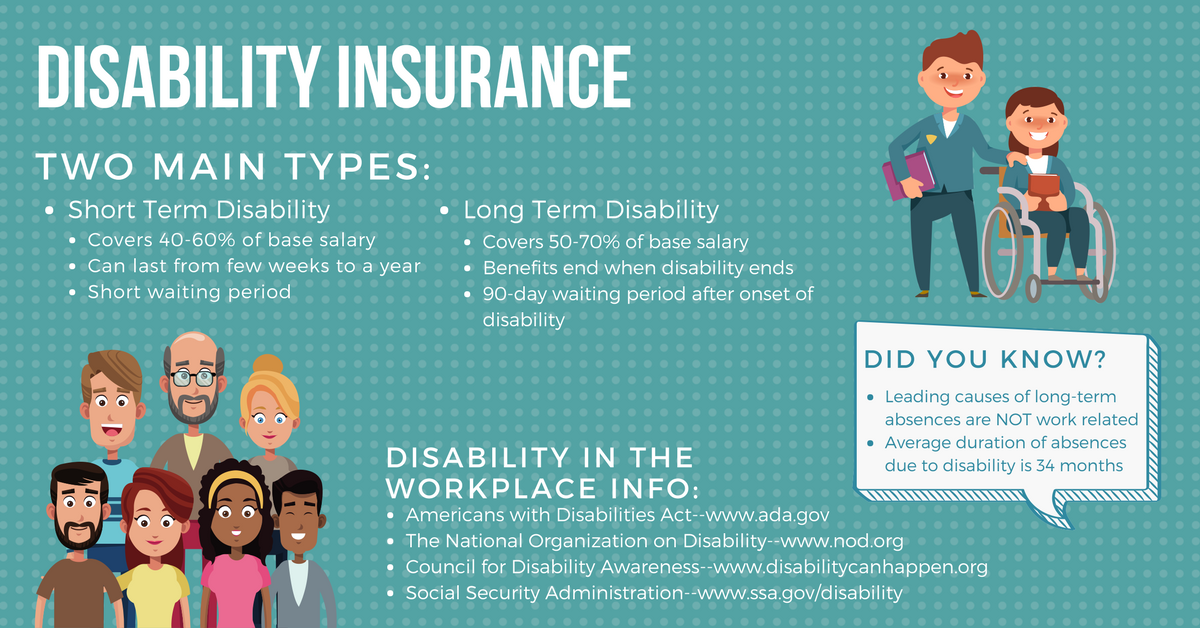

Understanding the importance of disability insurance is crucial for anyone who relies on their income to meet everyday living expenses. Life is unpredictable, and unforeseen circumstances such as accidents, illnesses, or injuries can drastically alter your ability to work. Disability insurance serves as a safety net, providing financial support in the event you cannot perform your job due to a medical issue. This type of insurance helps cover essential costs such as rent or mortgage payments, utilities, and groceries, ensuring that you maintain financial stability during challenging times.

Moreover, it’s vital to recognize that the majority of disabilities are not caused by accidents but rather by illnesses, which can occur at any stage of life. For this reason, obtaining disability insurance is not just a safeguard for yourself but also a practical decision for your family’s future. The peace of mind that comes from knowing you are protected allows you to focus on recovery rather than worrying about financial burdens. In essence, disability insurance is an investment in your financial well-being, enabling you to navigate life’s unexpected changes with confidence.

Top 5 Myths About Disability Insurance Debunked

Disability insurance is often surrounded by misconceptions that can lead to misunderstandings about its importance and benefits. One of the most common myths is that disability insurance is only necessary for those in physically demanding jobs. In reality, accidents and illnesses can happen to anyone, regardless of occupation. According to the Social Security Administration, about one in four of today's 20-year-olds will become disabled before reaching retirement age, highlighting the need for coverage across various professions.

Another prevalent myth is that disability insurance is too expensive for the average worker. While costs can vary, many options are available to fit different budgets. It’s crucial to consider that the financial protection offered by disability insurance in the event of an unexpected illness or injury can outweigh the monthly premiums. By investing in this coverage, individuals can secure their income and maintain their quality of life, which is especially important for those with dependents or significant financial obligations.

Is Disability Insurance Worth It? Key Questions You Should Ask

When considering whether disability insurance is worth the investment, it's essential to ask yourself several key questions. First, assess your financial situation: Can you afford to be without income for an extended period? If your answer is no, then disability insurance may be a vital safety net. Additionally, think about your current and potential future expenses, as well as any debt obligations that would impact your financial stability during a disability.

Another critical question to ponder is how likely you are to experience a disability. According to statistics, about 1 in 4 workers will face a disability that prevents them from working for at least a year. Evaluating your personal risk factors, such as your age, occupation, and overall health, can provide insight into whether disability insurance could be a wise decision. Ultimately, weighing these considerations will help you determine if the protection offered by this insurance is worth the premium costs.